From PayPal Intern to Starting 4x Billion-Dollar Companies - Joe Lonsdale Interview

()

The One Reason strategy (00:00:00)

- The most successful companies usually have one dominant reason for their success.

- Having multiple reasons for doing something often means that there is no strong reason at all.

- It's better to focus on one strong reason and push on that rather than trying to do multiple things at once.

- Making decisions based on blended reasons or having a blended strategy is a seductive trick that can lead to mediocre decisions.

- It's better to have one key reason for doing something rather than a long list of pros and cons.

- If there is no one reason that alone is worth doing something, then it's best to say no.

Learning Global Macro Finance from Peter Thiel (00:03:18)

- Joe Lonsdale reached out to successful people in college to learn from them.

- He met Peter Thiel, one of the smartest people he had ever encountered, and was drawn to his intellect and shared interests.

- Thiel's hedge fund, Clarium, focused on global macro finance, analyzing the big picture of financial markets from a top-down perspective.

- Lonsdale found global macro finance fascinating, particularly interested in long-dated oil prices and the impact of Fannie Mae and Freddie Mac on the global fixed income market.

- Joe Lonsdale interned at Clarium Capital, Peter Thiel's hedge fund, during his junior year of college.

- He was exposed to complex financial concepts and strategies, such as regression trading systems and hedging portfolios.

- Lonsdale gained valuable insights into the world of finance and developed a strong foundation for his future career.

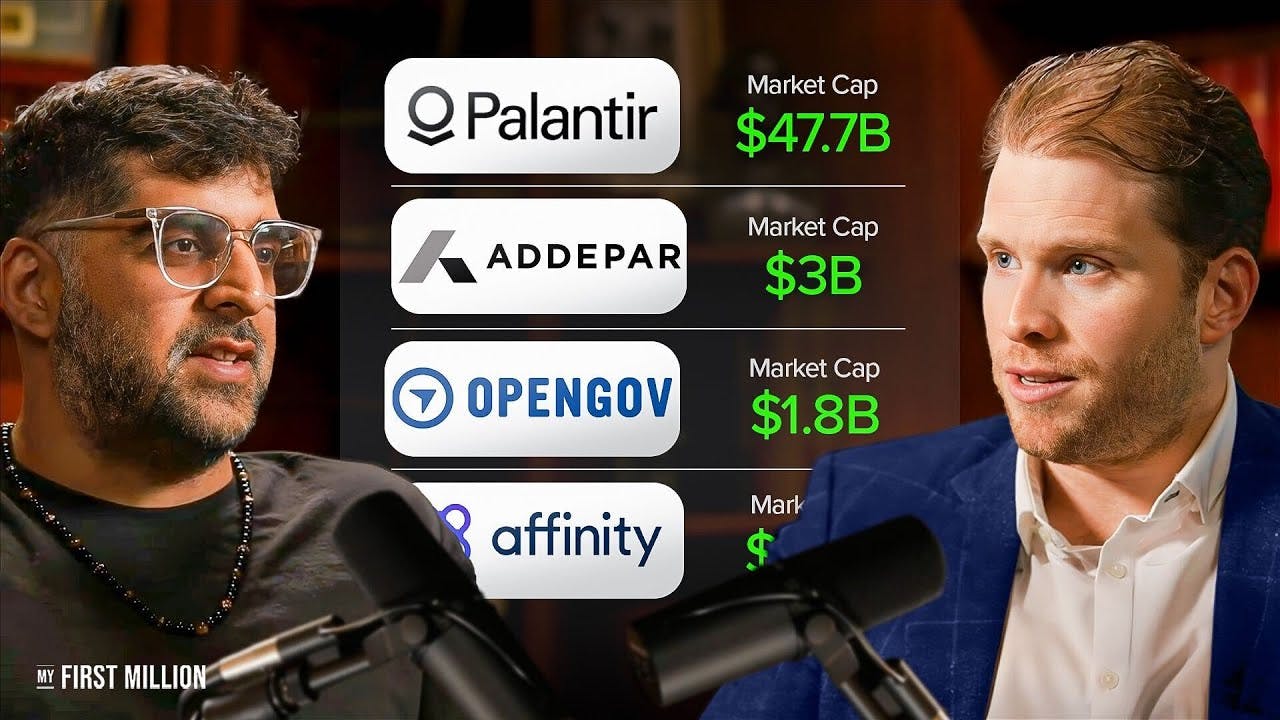

- After graduating from college, Joe Lonsdale co-founded Palantir Technologies with Peter Thiel and other PayPal colleagues.

- Palantir is a software company that specializes in big data analytics and is used by governments and businesses for various purposes, including counterterrorism and fraud detection.

- The company has grown significantly and is now valued at over $20 billion.

- Joe Lonsdale went on to found Addepar, a wealth management platform that helps clients manage their investments and track their financial performance.

- Addepar uses technology to simplify complex financial data and provide users with a comprehensive view of their assets.

- The company has over $1 trillion in assets under management and is used by financial advisors, family offices, and institutions.

- Joe Lonsdale co-founded 8VC, a venture capital firm that invests in early-stage technology companies.

- 8VC focuses on companies that are using technology to solve real-world problems and have the potential to make a significant impact.

- The firm has invested in over 200 companies, including Instacart, Cruise, and Flexport.

Taking multi-million dollar bets at 4:30am (00:05:35)

- Joe Lonsdale worked at a hedge fund in San Francisco.

- The market opened at 6:30 am, but on the first Friday of every month, traders had to come in at 5:30 am due to the release of non-farm payroll numbers.

- Kevin Harrington, the head of research, discovered an error in the seasonal adjustment of the numbers, allowing them to predict whether the number would hit or miss.

- This information was valuable as it could move bond markets significantly.

- Lonsdale and his colleagues took advantage of this opportunity by making large bets on the market's reaction to the numbers.

- It was a high-stakes game with potential rewards and losses in the millions of dollars.

- Lonsdale remembers the excitement and camaraderie of those times, celebrating successes and supporting each other during setbacks.

- Lonsdale's background in computer science and finance, along with his interest in those fields, contributed to his success in the hedge fund.

- He emphasizes the importance of being in the thick of things to truly learn and gain experience.

- Lonsdale acknowledges that the hedge fund took a chance on him despite his lack of extensive experience in the field.

Hire for raw IQ over expertise (00:08:43)

- Prefers hiring for talent, ambition, and hard work rather than expertise.

- Expertise is important for operating existing systems, but raw IQ and adaptability are crucial for building new systems or working in complex fields like high finance.

- Uses challenging math problems as an interview tool to assess problem-solving abilities.

- Relies on recommendations from within a network of top talent to identify exceptional candidates.

Nurturing employees into unicorn founders (00:10:33)

- Joe Lonsdale has mentored over 20 former employees who have gone on to start their own unicorn companies.

- Lonsdale believes in providing employees with useful frameworks and guidance, but also acknowledges that many of these individuals were already talented and driven.

- Some of these former employees have even gone on to create successful companies without Lonsdale's direct investment or involvement.

- Lonsdale worked at PayPal in the early days of the company.

- He learned valuable lessons and gained advantages from his time at PayPal that he was able to apply to his own entrepreneurial ventures.

- Despite some mistakes, Lonsdale and his team were able to build a successful company.

- One of Lonsdale's former employees from PayPal went on to start a company that was valued at $3 billion within four years.

Solving hard problems with Addepar (00:12:24)

- Addepar is a leading wealth management technology company in the US.

- It helps registered investment advisors manage their clients' wealth.

- It took three to four years to build Addepar and make it useful.

- Joe Lonsdale did not give up because he saw the potential and the challenge.

Always “Being on” (00:13:53)

- Joe Lonsdale is always "on" and engaged in his work.

- He loves what he does and finds it enjoyable and challenging.

- He believes in using one's mind to its highest capacity and finds complexity stimulating.

- To recharge and gain clarity, he takes cold plunges and schedules open time for creativity.

- His daily routine involves focusing on his fund, venture capital, building new companies, and strategy sessions.

How to spot opportunities for new businesses (00:15:32)

- Conceptual gaps in the world present opportunities for new businesses, and finding the path to bridge the gap between the current state and the desired state is crucial.

- AI can be used to improve the efficiency of loading yards in logistics by optimizing processes and creating accountability incentives.

- Building relationships and having strategic sessions with industry leaders, as well as involving entrepreneurs and residents in the brainstorming process, helps identify problems and opportunities.

- Joe Lonsdale emphasizes the importance of constantly looking for new ideas and opportunities, collaborating with talented individuals, and leveraging their expertise.

- Lonsdale suggests partnering with someone who already has an unfair advantage to increase the chances of success and stresses the significance of persistence and hard work in entrepreneurship.

- He encourages young people with entrepreneurial aspirations to seek out partnerships and support from experienced individuals.

How Epirus landed a military defense contract (00:21:10)

- Joe Lonsdale, a successful entrepreneur, shares his experience of starting multiple billion-dollar companies, including PayPal.

- Lonsdale observed the decline of the defense industry in the US and became concerned about China's growing technological advancements.

- He and his former Palantir colleagues identified electromagnetic pulse (EMP) technology as a promising area and discovered that the government had not fully utilized modern chip technology in this field.

- Lonsdale highlights the potential of directed EMP technology, which involves using microwave energy to disable electronics, particularly in defense against drones.

- He emphasizes the importance of competition in government contracts and pushing for laws that allow outsiders to compete on merit rather than longevity of relationships.

- Lonsdale's company, Epirus, developed a non-lethal technology that can disable threats like missiles and trucks without causing harm.

- Despite concerns about potential misuse, Lonsdale believes the technology has proven effective in eliminating terrorists, making it a necessary creation.

Getting hits in hard domains (00:27:09)

- Joe Lonsdale's successful ventures span diverse and challenging domains, such as logistics yards and EMP pulse technology.

- Unlike many entrepreneurs who focus on familiar problems, Lonsdale intentionally seeks out these hard areas where there's less competition.

- Lonsdale's experience at PayPal exposed him to numerous payment apps, making him realize the potential of applying technology to underexposed sectors of the economy.

Business Idea: AI-powered Estate Planning (00:28:24)

- Lonsdale suggests an idea for an AI-powered estate planning platform that automates the process of starting a trust and related legal work.

- He believes such a platform could revolutionize the wealth management industry by saving time and improving efficiency.

- Lonsdale acknowledges that the business might not reach a billion-dollar valuation but still considers it worthwhile due to its potential impact.

Business Idea: Business Process Outsourcing for local government (00:29:19)

- Trillions of dollars are spent by local governments, but many struggle to find the right staff for certain processes.

- A business process outsourcing company for local governments, augmented by AI, could be a huge business opportunity.

- The first 6-12 months of such a company would involve finding early partners willing to trust the company and work with it on outsourcing some of their processes.

- The company would need to figure out which processes cities are willing to let it handle.

- There is a secular trend towards local governments not having enough money, so if the company can find ways to save them money and provide higher quality service, there could be a significant opportunity.

Big swings vs. base hits (00:30:58)

- The speaker agrees with the philosophy of getting a solid base before embarking on a huge, risky quest.

- It is not advisable to be poor for 12 years while pursuing a noble mission if it can be avoided.

Idea vs. execution (00:31:49)

- The speaker believes that ideas matter and that project selection and picking the right market are crucial.

- Execution is the harder part, but amazing execution with a stupid idea will not yield results.

- Both ideas and execution are necessary for success, but ideas by themselves are not that valuable.

Focus vs. diversity of thought/attention (00:32:38)

- Focus is a superpower.

- The most successful people in the world have focused and compounded over a long time.

- It's okay to do different things when having an impact on the world in different ways.

- As an entrepreneur, it's important to focus and get a giant win before diversifying.

Insights from Elon’s inner circle (00:33:33)

- Elon Musk is very bold and direct.

- He is good at saying no to things that are not tied to his passions and focus.

- He is able to clear nonsense and mess out of the way to focus on what matters.

- Elon Musk was insanely focused for a long time on scaling his companies.

- He is now at a level of success where he can expand his focus to include things that really matter for society.

Joe Lonsdale’s unfair advantages (00:35:36)

- Has a huge talent apparatus with people at dozens of universities and a scouting department to find and recruit talented individuals.

- Has a network of people who run big industries and can provide advice and feedback on ideas.

- Believes in sharing ideas and iterating quickly, rather than keeping them secret.

- Prefers to be a minority owner of his companies and is generous with founders, employees, advisors, and partners.

- Wants to create companies where everyone feels like a co-founder and is proud of their work.

- Believes that the best way to develop an idea is to share it with others and get feedback.

- Has a network of people who respect him and are willing to help him iterate on his ideas.

- Can get to the right answer much more quickly because he knows everyone running everything.

How to invest your time to make your first $1M (00:38:48)

- Making a million dollars is not about investing money, but rather investing time.

- Disciplined investment of time is key.

- Saving money and being thrifty can work over a very long time horizon, but it's not the most efficient way to make money these days.

- Focus on learning how to build, create, and be useful to others.

- Find what you're passionate about and what you're good at.

- Spend time with people who are good at what you want to do and learn from them.

- Be part of a business and help it grow to see how everything works.

- If you're talented, the people you succeed with can help you do something new later.

Working on an A+ problem as an intern at PayPal (00:40:40)

- Joe Lonsdale tried to intern at PayPal twice, and was rejected the first time.

- He eventually got an internship and was tasked with setting up the PeopleSoft instance.

- He learned about finance and treasury by sitting next to someone who managed money on Bloomberg.

- PayPal was facing a challenge as the Chinese and Russian mafia were stealing money by writing down credit card numbers from customers at stores.

- This was costing PayPal millions of dollars per month and many competitors went bankrupt.

- Joe Lonsdale got involved in working on the solution to stop the fraud.

- Joe Lonsdale advises working on the A+ problem at any company, regardless of your role.

- The A+ problem is the real problem that the company is facing and needs to solve.

- Working on the A+ problem will give you the most learning, action, and impact.

- Joe Lonsdale almost quit his internship at PayPal because the work was not glamorous, but his dad convinced him to stay and be helpful.

- Joe Lonsdale also almost quit college because he felt mediocre compared to his peers, but his dad encouraged him to stay and challenge himself.

Be within 2 standard deviations of top talent (00:43:15)

- Being within two standard deviations of top talent allows you to appreciate and harness their abilities.

- Even if you're not the best, being very good at something enables you to recognize exceptional talent.

- This recognition allows you to hire and collaborate with highly skilled individuals.

- Joe Lonsdale, a successful entrepreneur, shares his insights and experiences on building billion-dollar companies.

Early days at Palantir (00:44:14)

- Joe Lonsdale worked for Peter Thiel's family office, which was the first investor in Facebook.

- He started hiring people and helping Thiel run things, despite resistance from some older employees.

- Lonsdale and his roommate Stephan sketched out cool products and built prototypes, which became the genesis of Palantir.

- They realized that the government was spending billions of dollars on outdated solutions to catching criminals and decided to create a better solution.

- Lonsdale and his team at PayPal were approached by Secret Service and FBI agents for advice on fraud.

- After 9/11, the government started spending heavily on supposed solutions to catching criminals.

- Lonsdale and his team saw that the government was wasting money on outdated technology and decided to create a better solution.

- They started Palantir to provide the government with more advanced technology for catching criminals.

Building a top engineering culture (00:46:56)

- Prioritize building a top engineering culture.

- Engineers should be respected and partially in charge of the company.

- Attract top engineers by offering challenging problems, opportunities to work with cutting-edge technology, and the potential to save lives and protect liberties.

- The government is spending billions of dollars in the field, but they are behind Silicon Valley.

- There's an opportunity to create a multi-billion dollar company by solving a complex technical problem.

- Engineers will get to work closely with National Intelligence and defense agencies.

- The mission is to save thousands of lives and protect liberties.

Borrowing trust as 21-year old defense contractor (00:48:31)

- Alex Karp, a philosopher and advisor, assisted the young founders in navigating institutional interactions and securing funding. His high-status connections and understanding of institutional dynamics were crucial in gaining credibility with government agencies and potential investors.

- Peter Thiel, a financial supporter and strategic advisor, prevented the company from entering into potentially detrimental early partnerships. His financial backing and strategic guidance were essential for the company's early success.

- When starting a business, it's important to focus on partnerships that align with the company's long-term goals and scalability. Avoid partnerships that may distract the company from its core mission or create unnecessary complexities.

Peter Thiel’s biggest contrarian bet (00:52:22)

- Peter Thiel becomes more expansive after his initial success.

- Thiel forgets the amount of effort and resources that went into his first success.

- Thiel's expansive approach leads to some questionable decisions, but his intelligence allows for some successful ventures.

- Thiel's investment in Facebook was one of many at the time and its potential wasn't fully recognized.

- Thiel's friend, portrayed as an African-American in the movie, helped him with the Facebook investment.

- Joe Lonsdale, a former PayPal intern, has founded four companies valued at over a billion dollars.

- Lonsdale's success can be attributed to his ability to identify and capitalize on market opportunities.

- Lonsdale is known for his contrarian investment style, which involves investing in companies that others overlook.

- Lonsdale's advice to entrepreneurs is to focus on solving real problems and to not be afraid to take risks.