The Trillion Dollar Equation

()

Bachelier's Contributions to Financial Mathematics

- Louis Bachelier, a mathematician and physicist, pioneered the use of mathematics to model financial markets.

- Bachelier observed the chaotic nature of stock option pricing on the Paris Stock Exchange and proposed that stock prices follow a random walk, making accurate predictions impossible.

- Bachelier's work laid the foundation for the Efficient Market Hypothesis, which states that consistent outperformance of the market through predictions is impossible.

- Bachelier discovered that the expected future price of a stock is described by a normal distribution, centered on the current price and spreading out over time.

- Bachelier calculated the expected return of an option by multiplying the profit or loss by the probability of each outcome and argued that the fair price of an option is what makes the expected return for buyers and sellers equal.

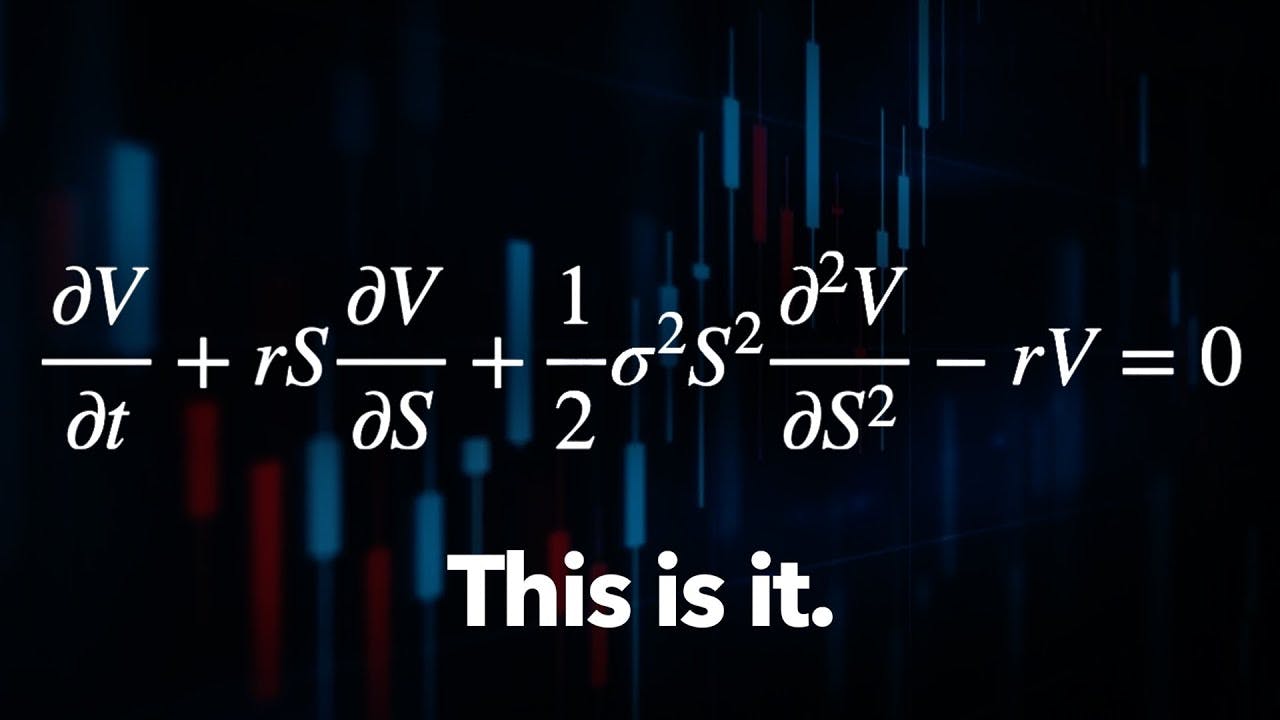

Black-Scholes-Merton Model and Options

- The Black-Scholes-Merton model, developed by Fischer Black, Myron Scholes, and Robert Merton, provides a mathematical formula to price options accurately.

- Options provide several advantages, including limited downside risk, leverage, and the ability to hedge against losses.

- The widespread use of options has led to the creation of multi-trillion dollar industries and transformed the approach to risk management in financial markets.

- In a call option, if the stock price goes up, the seller can eliminate the risk of losing money by owning one unit of stock.

- Dynamic hedging allows traders to profit from fluctuating stock prices with minimal risk by offsetting options with an amount of stock delta.

Efficient Market Hypothesis and Market Inefficiencies

- Research has shown that the efficient market hypothesis is false, and it is possible to beat the market with the right models, training, resources, and computational power.

- Ed Thorpe invented card counting in blackjack and later applied the same principles to the stock market, achieving a 20% annual return for 20 years.

- Thorpe developed a more accurate model for pricing options that took into account the drift of stock prices over time.

- Jim Simons, a mathematician, founded Renaissance Technologies and pioneered the use of machine learning to find patterns in the stock market.

- Renaissance Technologies' Medallion fund, which used hidden Markov models and other data-driven strategies, became the highest returning investment fund of all time, challenging the efficient market hypothesis.

Contributions of Physicists and Mathematicians to Finance

- Physicists and mathematicians have made significant contributions to the financial industry by modeling market dynamics, providing insights into risk, and opening up new markets.

- Einstein solved the mystery of Brownian motion by hypothesizing that microscopic particles move like a ball falling down a Galton board due to collisions with molecules.

- Their work has helped eliminate market inefficiencies by determining accurate prices for derivatives.

- Discovering all the patterns in the stock market could lead to a perfectly efficient market where price movements are truly random.