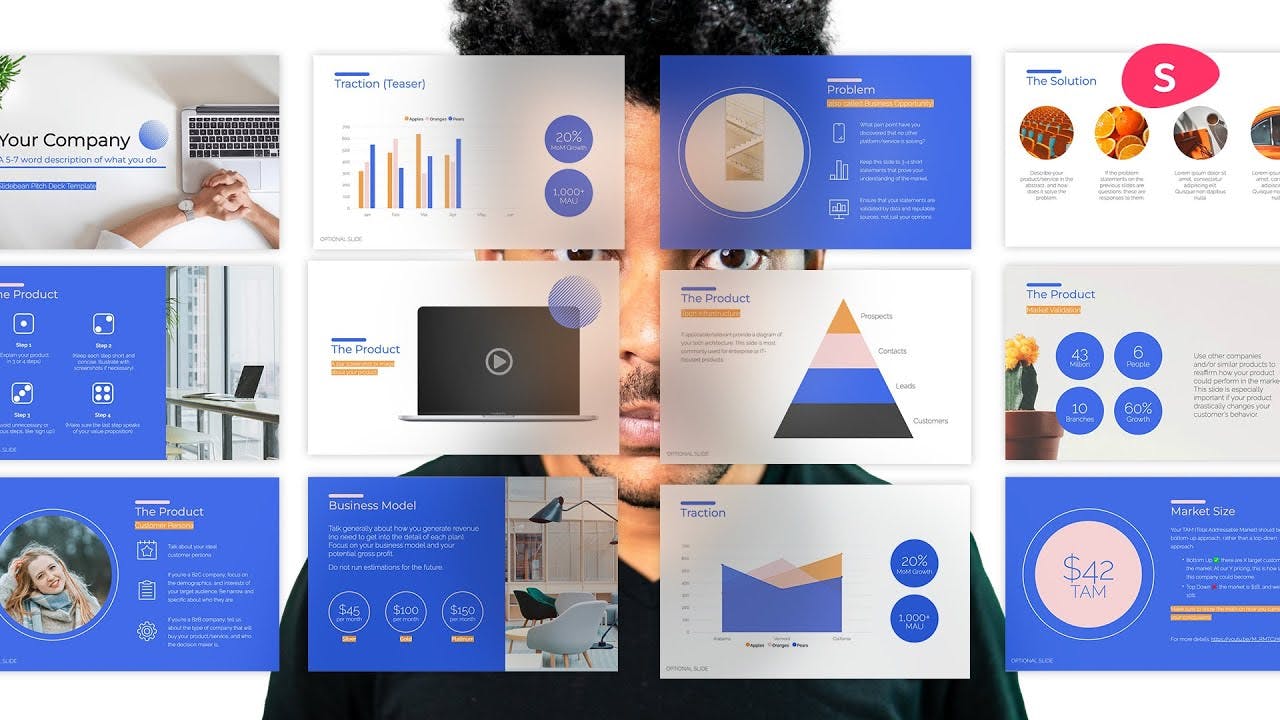

15 Slides you NEED on your Pitch Deck - Startups 101

()

The Status Quo (00:02:14)

- Discusses current market conditions and the startup's vision for a solution

- Explains the opportunity spotted in the market

- Showcases the product, explaining its function, target customers, milestones, roadmap, and business model

- Includes go-to-market strategies and market size potential

- Highlights why the startup team is positioned to change the status quo and how they outpace the competition

Status Quo & Product (00:05:07) & Tech Infrastructure Slide (00:09:13)

- Status quo tied to a clear market opportunity with real-world data

- Problems should be undebatable facts, not opinions

- Solution slides should offer a high-level view of what the company does, potentially without product features

- Underlines the importance of addressing a true market need—investors stop if unconvinced

- Demonstrates the startup's market expertise with solid, well-thought-out statements

- Product slides show the built solution, using screenshots and captions for quick consumption

- Features are explained as user benefits, "showing" is preferred over "telling"

- Unique technology can be detailed with a tech infrastructure diagram, useful for blockchain companies, among others

Market Validation Slide (00:09:23) & Audience Slide (00:09:53) & A Case Study (00:10:23) & Business Model (00:11:17)

- Market validation proves the concept with real examples, showing understanding of industry willingness

- Audience slides define the target customer persona, indicating focused feature and growth strategies

- Case studies demonstrate product adoption, utility, and impact on other businesses, indicating target industries and key decision-makers

- Business model slides clarify the revenue model without projections, focusing on how customers are charged

- Roadmap outlines product milestones and near-term goals funded by the proposed capital round

Market Section (00:11:54)

- Identifies growth trends and future growth potential

- Traction slide must show growth on core KPIs like revenue or active users, excluding vanity metrics

- Charts are preferred for visual representation of growth trends over time, providing context for recent figures

Go to Market Slide (00:12:41)

- Focus on one or two deeply developed go-to-market strategies.

- Include unique economics and costs if strategies are already in use.

- For new strategies, provide a detailed plan with timeline, budget, and expectations.

- Experience with the strategies is beneficial for proving effectiveness.

- Emphasize reaching the next fundable milestone with the raised capital.

Seed Funding and The Market Slide (00:13:41) & (00:14:12)

- Seed funding rounds for software companies typically require a live product and solid revenue growth.

- The goal is to reach the next funding milestone such as Series A.

- The market slide should show potential annual revenue specific to the business.

- Calculate annual revenue with the formula: potential customers x annual revenue per customer.

- Confirm that the business model matches customer acceptance and market fit.

- Understanding the number of potential customers is critical.

Competitors and Team (00:17:29)

- Convey superior market understanding and why the team is better than competitors.

- Use comparisons that show clear market insight, such as feature lists or approaches revealing competitor weaknesses.

- Highlight team members with skills crucial for reaching the next milestone.

- Focus bios on industry expertise, related experience, and concrete achievements.

Finding Co-Founders (00:16:49)

- Industry expertise and related past experience are important in team bios.

- Ivy League education is less impressive than relevant experience.

- A 'why now' slide can be beneficial to indicate urgency or market opportunity timing.

- Frame a 'secret sauce' slide to show unique technology or connections that provide a competitive edge.

The Secret Sauce and Financial Estimations (00:17:29) & (00:17:49)

- Present unique advantages like technology or network connections that build a protective moat against competitors.

- Conclude with financial estimation and ask slides detailing the amount of capital being raised, the terms, and use of funds.

- The last slides are not story-driven but are crucial for financial planning.